“Be your money’s master, not its slave. ” ~Publilius Syrus

Buy NOW, pay later.

We are all guilty of it. Getting that new phone, new car, new handbag . . . you name it, we put it on a credit card or pay down a loan over time.

What’s the big deal? I can afford the payments.

Do you know how crazy that sounds? Imagine this: Paying $50 a month for the next 2 YEARS toward a new phone because the idea of spending $1000 on a phone seemed too extravagant!

It’s nuts! But, we ALL do it . . . ALL of the time.

It’s a phone! I spend less on my monthly gas bill and that’s a NEED.

Therein lies the rub . . . is it a WANT or is it a NEED?

Focus on your NEEDS and it will be easier than you think.

But I want it NOW!

“Adults devise a plan and follow it, children do what feels good.”

~Dave Ramsey

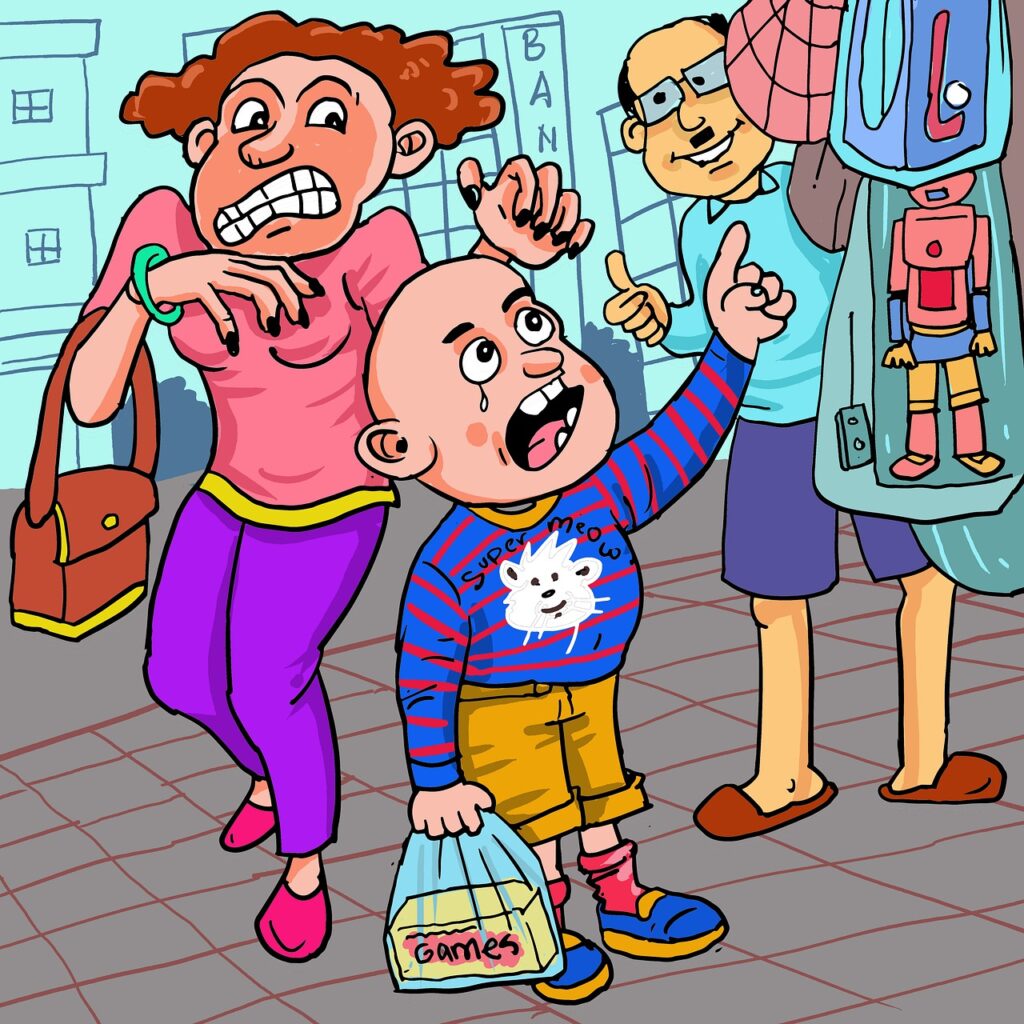

I am sure most of us have witnessed that screaming child at the checkout stand, “But I want it NOW!“

If you think about it, we are ALL just trying to succeed at “Adulting“.

Every time you think about a purchase, you have to ask yourself, “Am I the child or am I the adult?”

Lighten your load.

Stop taking on any more debt and start paying down existing debt, one bill at a time.

I follow the Dave Ramsey snowball method.

What is that?

You pay minimums on all debt but the smallest, and throw any extra money at the smallest debt until it’s paid off. You work your way through each debt until you have nothing left but the mortgage.

Does this take time? Yes. But, there is nothing like being debt free.

What about investing?

If you pay down your debt, you are getting an immediate return on that borrowed money. According to U.S. News and World Report, the average interest rate on credit cards in July of 2021 was 15.56% to 22.87%.

Yes, you read that right. A whopping 15-20%, on average!

By paying down your credit card, you are getting an immediate return on your money, that’s guaranteed! Much better than the stock market could ever offer.

So next time you think of taking on any more debt . . . don’t.

Sounds like discipline is key. Sometimes I falter but it is nice when a credit card bill disappears. I never thought of the payment of credit cards as an investment. But it your argument makes perfect sense. Thanks.